Acquisition project | Arindam

Main work

At Decathlon Sports India, we’re more than just a retailer—we’re a movement. Our mission, “Move People Through the Wonders of Sport,” reflects our dedication to making sports accessible to all, from beginners to seasoned athletes. With a wide range of high-quality gear at affordable prices, we cater to over 80 sports and serve as your one-stop shop for an active lifestyle.

We're also deeply committed to India, investing €100 million to expand our presence to 190 stores while focusing on locally made products and sustainability. At Decathlon, we’re not just selling equipment—we’re building a healthier, more active nation.

Rough work

The question

Where can you find affordable, high quality sports equipment, athleisure garments and a supportive community for a wide variety of sports, both main stream to niche for people of all age groups regardless of skill levels?

The market size

Decathlon servers the beginners, the contemplators, the sudo active, the aspiring athlete, seasoned athlete, the discoverer, the rediscovered of all ages for almost all sports. If we missed it, you probably wont discover it.

The problem

The number of people who engage in sports after their school or college days dwindles rapidly, reasons could be many,

- they drop out of communities

- limited access to sports facilities (grounds, pitch, pool, tracks etc)

- sports equipment availability

- cost of sports equipment

- hesitation to start something new, epically when alone.

- Life got into the way, couldn't carve out time with work and kids

all these reasons culminate to a sedentary lifestyle and eventually lifestyle diseases.

The Solution

One big box store, or one website, or one location that offers everything that missing. High quality equipment at the right price for every age group and skill level. Find groups and communities within the store. Meet other people or find out where you can enroll and start learning and practicing the new sport. Our staff is super friendly and will match you to the right equipment without any judgement. There is plenty for you and your family here. Everyone is engaged, No one has to be left behind.

How are we different?

- affordable and value for money

- wide range of products

- experiential retail - try it first and then buy it. return it if you didnt like it.

- Localized strategy - what sports are played here? what kind of equipment the local population is used to, what fabrics do they like to use and what colours. what kind of help would they appreciate while shopping. How do they like to leave their feedback? etc

- Local sourcing - YoY we are increasing the number of locally made goods in our stores

- Grassroots and community connection - we connect with your - directly. our stores, our products and our staff are all the superstars and celebrities we need and you need. You can trust us for who we really are rather than who we try to sell our selves as.

Our traction

Our revenues in India have hit 3600 CR with over 40% growth in the past year - this is huge. this shows how much our customers love us.

Long tern

we are here to stay and help you through your journey of discovering and participating in sports and activities of your choice. we are here to cheer you as you build a better and healthier version of yourself as you

- we are expanding our foot print - opening more stores and opening smaller stores to move into the denser parts of the city. make our selves more accessible to you

- we are working to make our online store (our app) easier to user and partnering with distribution channels like quickcomm to make sure we could come to you when needed.

- we are improving our in store technologies to help you get more info on products and sail through the check out as easily as possible. no need wait at long check out counter Qs.

- we are increasing local manufacturing - this way we can keep the costs low while also supporting the local communities through gainful employment. Also, by shortening the supply chain we are able to reduce our environmental impact which means we and you, our customers, are getting greener.

Why people like decathlon?

- Its cheap

- always good quality

- Lot's of options

- covers every sport (at least the ones generally accessible in India.

- Family entertainment - kids like the the place. They are engaged. almost like a mall.

- Encourages outdoor activity. Gets Kids off the screen and motivates grown ups towards physical activity.

Understanding The Product

Sporting categories

The obvious classification decathlon has towards all the internal brands and products it offers is the sporting categories and they are as follows.

Cat / sport -> | |||||||

|---|---|---|---|---|---|---|---|

Outdoors | Hiking & Trekking | Camping | Wildlife Watching | Skiing & Snowboarding | Rock Climbing & Mountaineering | Fishing | Horse Riding |

fitness and yoga | Fitness Cardio | Body Building & Cross Training | Kids Sports & Gymnastics | Boxing & Martial Arts | Yoga | ||

Water sports | Swimming | Surfing & Beach Sports | Snorkelling & Diving | Kayaking & Stand Up Paddle | Sailing | ||

Racket sports | Badminton | Tennis | Table Tennis | Squash | Padel | ||

Team sports | Football | Basketball | Cricket | Volleyball | Hockey | Rugby | Baseball |

Running and walking | Running | Walking | |||||

Cycling | Cycling | service | |||||

Skating | Skateboarding | Scooter | |||||

other outdoor | Golf | Archery | |||||

In-door | Darts | Carrom | Billiards |

Beginner vs Advanced (athletics)

What further emerges from the product catalogue is the fact that every sport has

- Low price barrier of entry - beginner equipment

- medium to high priced space for the user to grow into - in line with big brand market but labeled as higher league giving it higher status in this store than the competition gives similarly priced products within their catalogue.

Mainstream vs Niche

Another finding within the extensive offering is that the sports themselves could be classified as mainstream such as cricked, football etc and niche like fishing, camping etc. This is a regional factor which mostly serves the purpose of exploring markets early

Sports equipment vs Apparel

Decathlon sells a disproportionally large quantity of apparel catering both casual users and serious athletes. This is evident buy the catalogue of over 7000 different garments across sports categories and also by the fact that more than 30% of their revenue in 2023 came from apparel business. Not all buyers are buying the apparel for sports. The apparel also serves as a casual fashion choice for a wide category of users.

Impulsive vs High consideration

One more product level classification they make apparent through their store layout is the accessory/low ticket items vs the slightly more expensive items that need more exposure and consideration to buy.

- impulse - These could be caps, bags, energy bars, exercise bands, towels etc that are usually priced under 200 and placed at multiple locations along the store in bulk placements. They are also placed at the checkout. Easy to pick up, Not much to think about

- The high consideration items - these are items that users need to experience before buying and are usually found within their own section. Discovery for these items follows users expectations of where they can find them.

Additionally seasonal layouts sometimes also determine what items are high consideration vs what are now. for Eg: In rainy season a slightly more expensive umbrellas would be looked at as low consideration as against a water bottle which would be a low consideration impulse buy in the summer.

Online store

The above classifications culminate into a single experience when the store is accessed online through the decathlon app. The experience within the app becomes paramount.

- How quickly did the pages within the app load

- how easy was it to find the product as against encouraging longer discovery times in the instore experience.

- Were the discounts displayed upfront

Understanding the User

User interviews

The fundamental questions I posed some of the users within my network were as follows

- What did you buy at decathlon?

- What is the biggest challenge/ difficulty about buying this product in the market these days?

- Did you try buying this product elsewhere? if yes, what was your experience in that store?

- Why did you buy the said product at decathlon?

- Did decathlon make it easy for you to buy this product?

- If yes, how did it make it easy?

- what is the typical price range for this product to be value for money for you?

- how do you evaluate the quality of this product when you shop?

- Casual use or specific use? (when applicable)

- Did you buy this same or similar product before? if so, when?

- how often do you buy this or this type of product?

- what do you think about brands in decathlon as against brands like Nike and Adidas?

- Would you be disappointed if decathlon shut down and left India sometime soon?

Based on the interviews here are few user personas that I came across:

Casual apparel

This shopper is always on the hunt for a good deal, but they don't want their clothes falling apart after two washes. They are keen on maximizing the quality within their budget. They usually wait for festivals or special events to buy new clothes. They're tired of having to choose between cheap clothes that don't last and brand names that cost too much.

They do most of their shopping on Amazon and Myntra, but face the all to common problem - what looks great online can be a total letdown when it arrives. Either the quality is lower than expected or the fit is an unpleasant surprise.

With a budget of ₹500-600 per item, they've found their sweet spot at Decathlon. Sure, it's technically sportswear, but they're not exactly training for anything - they just love how the clothes hold up for everyday wear without costing a fortune. If Decathlon suddenly closed shop, they'd definitely miss it, though it wouldn't be the end of the world.

Cycling - High consideration

This customer is getting back into cycling after a 20-year break, just looking to enjoy some leisurely rides around their neighborhood. They've been taken aback by how much cycle prices have shot up since their younger days, without seeing a matching boost in quality.

Other cycle shops have been overwhelming. There are countless options, but many seem poorly made, and it's hard to tell which store they can trust. Finding a decent cycle under ₹10,000 has been quite the challenge, and they're worried about being left high and dry when it comes to repairs and maintenance.

They really like the fact that decathlon has service centers within each of their stores. For them, knowing they won't have to hunt around for reliable repairs and parts is just as important as the cycle itself. While they're generally satisfied with what Decathlon offers, they'd certainly be concerned if the service support disappeared after making their purchase.

The customer found decathlon to be a sweet spot of quality, price and after sales support.

Sports equipment + specific apparel - for self

The customer is a budget-conscious individual seeking fitness equipment and apparel for personal use. Interested in starting a new physical activity—this time badminton—they are looking for a good-quality racket, shoes, shorts, and t-shirts. However, they find that big brands like Nike, Reebok, Yonex, and Under Armor offer quality products but are priced beyond their comfort zone.

Having attempted to take up running about 10 years ago, they invested ₹8,000 in running shoes but rarely used them, recognizing a tendency to lose interest in physical activities over time. Aware of this pattern, they prefer to limit their initial spending to minimize potential waste. They typically explore a new sport every 5 or 6 years but are cautious about making significant financial commitments upfront.

With a budget of around ₹4,000, they seek affordable yet reliable equipment and apparel to support their renewed interest in fitness. They value the convenience of finding all necessary items in one place, simplifying the shopping experience. Seeing everything they need in one place has indeed motivated them to go ahead with it, and they would be somewhat disappointed if such a resource were no longer available.

Overall, they prioritize affordability, convenience, and the ability to access a variety of sports gear without overspending.

Sports gear and apparel for children

The customer is a concerned parent facing the everyday challenge of getting their children to spend less time on screens and more time engaging in physical activities.

Enrolling the kids in sports like tennis or cricket involves significant expenses. Thousands of rupees for coaching fees and additional thousands for equipment. While there are options at local sports shops, the parent prefers to start with affordable, good-quality beginner gear. They also have been suggested to try the beginner equipment here at decathlon by the sports coach. They plan to invest in better equipment after the children have committed to coaching for at least a year.

With a budget of around ₹5,000 to ₹6,000 per child, the parent also needs to account for new clothes and shoes every year due to the children's growth. They appreciate that Decathlon offers a convenient, cost-effective solution with reliable quality, making it easier to equip their kids without overspending. The parent values the store's quick service and the assurance of product quality, expressing a strong desire for the store to continue operating.

ICP

deriving from the above personas - following are the ICPs

Attribute | ICP1 | ICP2 | ICP3 | ICP 4 |

|---|---|---|---|---|

Name | Rajesh | Smitha | Vipul | Prabhu/Prabha |

Age | 25 - 30 | 35-45 | 45 - 50 | 18 -25 |

Gender | M | F | M | M/F |

Income level | 80 to 1.5 LPA | 1 to 2 LPA | 1.5 to 3 LPA | 0 to 45K |

Education | Graduate - technical | Graduate - Arts/technical | Graduate - Arts/technical | UG |

Occupation | mid level - dev | Jr Manager - audits | Regional sales manager | Student, Business analyst |

Industry sector | IT, ITES | Finance | Manufacturing | |

Marital Status | married/single | married/div | married | Single |

Family Size | 2 | 1, 2 | 4~5 | 1 |

Geographic Location | Urban - Kochi | Urban - BLR | Urban - Pune | Urban - Jaipur |

Life Stage | Newly married | weight watching | career growth | first job |

Vehicle Ownership | 2W | 2W/4W | 4W | nil - 2W |

Need | High-quality and value casual clothing | Personal fitness gear and apparel | Good quality sports gear and equipment for children | Fashionable sports ware |

Pain Point | Low quality at low price point | budget and discovery | budget due to repeat buying | Price point, Fashionable gear |

Solution | Affordable high quality clothing | Affordable all in one offering | Affordable beginner friendly gear | Affordable and fashionable |

Influencers | Positive wom, brand reputation and trust, convenient store locations | affordable one stop solution, product trial opportunity. Peer influence | wide product range, convenient family friendly store, product trial, | Higher presence in social media, celebrity endorsements, |

Blockers | Limited fashion forwardness, sports focus | low community support of the specific sport, | Child's lack of interest, Child's academic calendar, Child's perception of the brand. | |

Buying Behavior | Shops during festivals | tries new sports every few years | shops annually for kids | need based |

Product Usage | Regular, lite | Irregular, heavy | Regular, Heavy | Regular |

Benefits Sought | ||||

Technology Adoption | Medium - will try online shopping but self checkout is pushing it | High - happy to shop online and use self checkout in store | Medium - but not resistive. open to try out online and in store tech but values experience - especially with kids sports needs. | High - Tech first. would prefer shopping online over going to a store if its for apparel only. |

Interests and Hobbies | Music, tech DIY, foodie, | Fitness and well being, healthy eating, spending time with friends. | Movies, spending time with kids, chess/carroms, | |

Perceived Value of Brand | Trusts Decathlon for value and convenience | Sees decathlon as essential, affordable and reliable | sees decathlon as affordable | |

Marketing Pitch | ||||

Goals | | |||

Average Spend on the product | 500 - 1500 | 3000 to 5000 | 4000 - 6000 | 200 - 1000 |

Value Accessibility to product | High | High - availability at one location | High | High |

Value Experience of the product | High - Quality | medium - returns before 15 days | High | low |

Psych factor | Make in India | Sustainable and environmentally friendly | Instant child feedback on product | Brand origin story |

ICP Prioritization

ICP | Adoption rate | Appetite to pay | Frequency of use | Distribution potential | TAM |

|---|---|---|---|---|---|

ICP1 | Limited | Mid to low | Mid | Low | High |

ICP2 | High | High | Mid | high | Mid |

ICP3 | High | High | High | high | High |

ICP4 | High | Low | High | high | High |

Based on the above prioritization table ICP 2 and ICP 3 are worth targeting.

The Competition:

Decathlon is currently competing with

- Puma

- Adidas

- Nike

- reebok

- Asics

- Other smaller local players like yonex, cosco, etc

Tim-TAM-SAM-SOM anyone?

Sports and fitness goods market in India is currently valued at $5.1 Billion (with a Ba!). Now granted that this number also includes export potential but decathlon too is viewing India as a global production house and targeting the same export potential as the rest of the industry. The overall segment is expected to grow at (CAGR) 8.9% and decathlon could be placed right for this growth

This growth is primarily driven by increasing health awareness (ICP2), increasing disposable income (ICP3) and growing interest in various sports across the population (endless growing interest in sports among children! ICP3!)

If the almighty TAM is at $5.1 Billion, decathlon sits at a revenue of Rs. 3,955 Cr which is at $471 Million in 2023 while the collective main competition are clocking in Rs. 11,617 Cr. I think decathlon can get SOM more!

Decathlon keeps its SAM broad because of its extensive product range when compared to its competition. We can consider the SAM to be around $4.5 B

Decathlon undercuts the competition in pricing by 30% to 40% across the product range. This affordability is truly the core value prop of decathlon. As it aggressively grows YoY by doubling its number of stores and adding smaller stores in urban areas that are more focused in apparel and other accessories decathlon stands to grab a larger percentage of the market share targeting expansion of its SOM to $1 B

Search

Decathlon draws a traffic of over 5 million every month through organic searches. It also has a domain authority score of over 75. This is comparable or better than the competition. However, There is a great scope for improvement to capture some of the traffic in the mid to top of the keyword funnel through content driven improvements.

The serp results for non branded search within sectors decathlon aggressively competes is no favoring decathlon. There needs some improvement in the free listing products and marketing placement

Improvement of search will lead to a consistently low or flat CAC while acquiring newer customers online. This is in line with decathlons aim to grow its revenue share from the online store in 2024 - 2025. This would also help discovery of its rapidly growing offline stores across the country.

Search also works great when strong offline presence contributes to a robust brand recall which is the case with decathlon.

Referral program

Decathlon built its brand value through its communities. They drive positive WOM in all the experiences they offer. The instore experience is full of AHA moments and positive flows. The support staff at decathlon is extremely helpful and usually knowledgeable. They try their best to get the right person to answer the call. Floated this AHA moment up when they went in to buy a badminton racket. The person who advised them was a national champion and is part of a training group in one of the academies locally. He also offered to connect the customer to a local community and add her to a telegram group that usually plays at a local court. This presence of grassroot interactions is why a referral program would work great.

Channel Name | Cost | Flexibility | Effort | Speed | Scale | Budget |

|---|---|---|---|---|---|---|

Organic | Low | Low | Mid - at mature scale | slow | high | Low |

Paid Ads | high | high | high | fast | high | High |

Referral Program | Low | low | high - one time | variable | high | low |

Product Integration | High | High | High | variable | High | High |

Additional channels

Decathlon is also expanding its store count offline. They are working towards expanding as both big box format and also smaller urban stores with limited range. Focused more on apparel and accessories. This would boost a section of their business that is already bringing in over 30% of total revenue.

👑High level stats of SEO at decathlon

Decathlon is doing great in India when you look at their overall SEO performance

- They have a high authority score of 74

- Organic searches stand at around 5.5 Million per month!

- They have over a million backlinks working for them. Domain authority says it all.

This is great!

But lets look at the 🗝️Keywords

that are pulling in all this traffic.

Mostly Branded keywords with navigational or transactional intent!

This is great but this also means there is a lot left on the table when it comes to discovery and a quick google search across the funnel confirms this. Now lets take a closer look.

🔻The SEO funnel and how Decathlon is doing?

Lets consider a simplified journey of someone discovering decathlon online

Informational search

Keywords at this stage are extremely top of the funnel, Keywords are broad and the intent is all over the place. A good measure is to develop the informational keywords through a blog content. This is predominantly content driven when keywords are such high in the funnel.

A user at the very top might search based on

- Goals - "getting fit playing sports" or "sports fitness" or "weight loss through sports"

- Comparing the overall direction of the fitness journey - "gym vs running" or "gym vs badminton"

- specific sport based searches - "badminton coaching" or "badminton courts" or "badminton classes"

In all these cases decathlon might not be leveraging its blog content to capture these top of the funnel keywords.

Investigative keywords

A little lower down the funnel the user might be interested in a perticulur sport but is unsure of how to go about the journey. There is a lot more to explore. eg

"badminton coaching" , "cricket coaching" , "tennis courts around me", "swimming membership"

This too could be best service by blogs but is totally missed out by decathlon. It feels a greater miss given how strongly community drive the buying decision of decathlon customers is.

But also in the investigative intent is someone searching for the equipment and gear needed for their fitness journey. the keywords at this point narrow down further to "best tennis rackets for beginners" , "best badminton rackets", "cricket kits for beginners", "football shoes for adults" etc

⚠️This is where decathlon starts missing out on multiple serp features

- Traditionally ranking wonk let pages ran up on the first page

- the sponsored listing capture a considerable section of the page

- Google free listing options are full of competition where decathlon is mission out - "Popular Products" section

- the Deal price section - again a google free listing section - Decathlon is missing out

- and finally people also asked for - Where Decathlon presence is completely missing.

The same story repeats for cricket or swimming or many other categories. It seems that decathlon has a lot to gain when solving for google free listings of products and Marketing methods (previously known as Destinations) within their google merchant center.

Also, this same trend continuous when we step up the intent with keywords like "buy badminton rackets online" or "buy cricket bat" or "cheap badminton rackets" etc.

Transactional and navigational

This is where most of the work has gone into. With branded keywords in the mix, the search results are clearly favouring decathlon and there is no further immediate improvement required here.

Keyword Gap

There is also a great potential to tap into the low competition underperforming keywords at the competitors websites.

Decathlon shares about 30K keywords with its larger competition in general. with all the overlapping and divergence in the mix, there are few untapped keywords that could quickly turn into results.

Decathlon is loosing position to adidas on some of its top non branded keywords. solving for these would bring it back to the first page, increasing its traffic by over 70% for these keywords.

When compared with their competition directly some of the keywords that decathlon are straight up missing are as follows

The volume on these missing keywords is high while the keyword difficulty is moderate to low. These opportunities should be exploited first.

Decathlon also seems to be be at its weakest against its competition when it comes to keywords related to shoes. the KD on these keywords is again moderate to low. These too can be considered top opportunity.

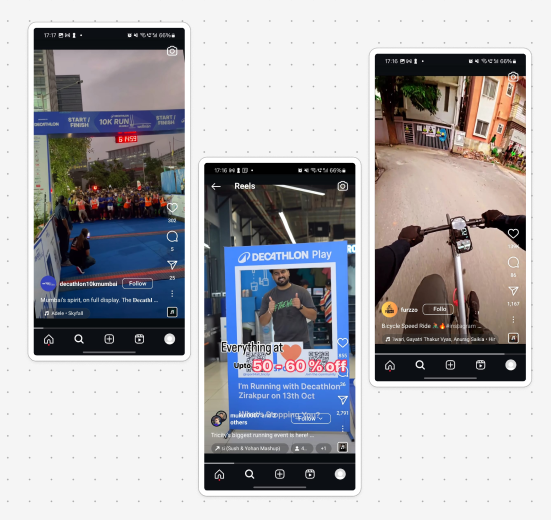

Decathlon drives content through its community events and corporate events. Some of these community events are free and some have an upfront free.

The content is a mix of user generated and brand generated:

A further deep dive into the content loops is not covered in this project.

Ads on FB and Instagram

Decathlon runs a limited set of value driven simple FB and instagram ads. They have no celerity enforcements. This is primarily to keep their CAC in check and subsequently keep their product prices 30 to 40% below the competition pricing. Their facebook/instagram ads cater to both individual customers and B2B customers.

Almost all their online ads have a CTA as "Shop Now" they send all traffic directly to the website. No landing pages or lead forms.

Google ads

Similar to their limited engagement in Facebook/instagram ads, they run a limited set of search ads. they target about 12 keywords. These keywords are usually a mix of branded and unbranded (specific product descriptions of their catalogue) thus help them keep their bid costs very low. This lack of aggressive expansion in the ads space sits well with their ethos of keeping CAC low and passing on the savings to the end consumer.

They gain a traffic of about 6.4K from their paid searches as against 5.6 million from their organic traffic.

Further deep dive is not included in this project.

Decathlon is driving product integrations on two fronts.

B2B sales

Decathlon offers bulk discounts to sports clubs and schools. This allows for them to under cut the market while also monetizing their partners upfront. The end users of these bulk procured equipment usually end up buying similar products for their own use from the decathlon store either because they have certain familiarity or they were recommended to do so by their coach/teacher/facilitators.

Marketplace integration

Decathlon products are now available in other marketplace platforms and quickcomm platforms.

Decathlon on flipkart

Decathlon on zepto and blinkit (soon)

Further integrations are not explored in this project.

👬Referral Acquisition

Referrals could work like bonkers for Decathlon. This brand has put its heart and soul into building grassroot communities that truly trust the brand from the bottom up. A brand that gave them the most value for money when they were just starting in this sport or that, in this community or that, for the 1st time or the N -th time... WOM is a strong positive for decathlon. Referrals would be supercharging this WOM (🐛 Dune wom?)

Decathlon has happy moments they have been capturing both in store and online on the app. This data can help them build some unique referral flows that merge the online and the store experience

😆 Happy touchpoints

Compared to the west, we do experience a lower level of trust in our retails spaces. When a brand like Decathlon comes through with its promise, It shoes on the customer's face. Like when-

- 🤑 Unexpected Savings at Checkout: Customers pick up high-quality items already priced lower than competitors and delight in discovering an additional discount at checkout.

- 😮 Surprising Finds: Shoppers enter for a specific item but end up with a cart that goes beyond the theme, adding fun extras like a cap, shoes, or a fanny pack to a swimming pool party.

- 🔂 Repeat Purchase Love: After trying and loving an item, customers eagerly return to stock up, confident in their choice.

- ↩️ Hassle-Free Returns: When a product doesn’t meet their needs, customers experience the ease of a no-questions-asked return policy, building trust and peace of mind.

- 👨👨👦👦 A Joyful Family Outing: The whole family enjoys their time at the store, and at checkout, they happily select the "very satisfied" smiley on their way out.

- 🦸 Checkout with Zero Wait: Long lines are a thing of the past with Decathlon’s self-checkout options, allowing customers to scan items and pay via phone for a smooth, seamless exit.

- 👷 Helpful and Relatable Staff: Assistance feels genuine, as staff members are knowledgeable and relate personally to customers’ needs, offering advice that feels more like a friend than a salesperson.

- 😀 Effortless Online Shopping: Shopping online is as satisfying as in-store, with fresh, high-quality products delivered quickly. The app makes reordering a breeze, bringing the Decathlon experience to customers’ phones.

😎Bragworthy things about the product

- Endless choices for every sport known and unknown!

- High-quality sports gear without breaking the bank.

- Seen Everywhere, Available at decathlon.

- Self checkout in Seconds: Pick, scan, pay, and walk out

- no rookie mistakes when buying as a beginner. show up in the right gear on day one (unless you wore shirt inside out or helmet back side front 😬)

- Not satisfied? Return any item with no questions asked

💰Platform currency

The platform currency could be sporty points. Use then points against products in store or online. Get bonus pots to use against seasonal sales etc.

🙃 Who and when to ask?

🚶Flow 1

Shopping done in store -> cart self checked out or manual check out -> hit the "very satisfied" smile 😀 on the checkout counter

Flow 2

Customer walks into the store -> picks up 2 or 3 or more of the same item -> this is the second time they are buying the same item

Flow 3

Customer buys online -> customer receives the order -> Clicks the feedback link and shows some love..

🔍Discover the referral program

At the end of these happy flows, rather than thanking the users for the feed back, there should be a simple big button to refer a fried. The words used here should be in line with the brands tone like "Bring a friend into the game and score Sporty Points"

Post shopping in the store, for the first flow, the users can get a push notification on the app if they have rated their experience as positive. I understand that the push is scarce resource but you are only pushing a recently happy customer. The love wont be forgotten too quickly.

Referral sharing and communication 💬

One simple message:

Bring a friend into the game and score Sporty Points

Two simple buttons

No alpha numeric codes, no blue links, no QR codes.

Referral tracking

The home of decathlon app has a tiled approach to its navigation. its got sections at the bottom. the account page at the bottom right corner could be the perfect location for the referral program,

The account page itself has sub menus shown as tiles. As observed there seems to be a half hearted implementation of a platform cash program that is primarily driven by purchasing. This could be replaced with referrals page. It also makes lots of sense for the referral page to also show all the points accumulated through both referring and purchasing no real functionality is lost with this change.

every time a referral is successful, the new score of the points can be shown in gold or a shiny blue (brand colours) with a Plus logo popping into existence next to it indicating some score has been added. Or, every time there is a positive change to the referral point, the score can pop up into a slightly bigger font, get more prominent and update itself with a roll effect on the numbers.

🎢Continuous referrals

If platform cash is level one, social validation could be level two. Say a user has pulled in 10 of his/her friends, they may be offered

- A pass to the next sporting event that decathlon is hosting at the preferred store location of that power users. The passes could also give its power users time access to the courts or other sports facilities at preferred location.

- All the the referred friends now see your name on their check out screen, maybe - ✋high five to Prateek

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.